Investment Philosophy

Mileage makes champions

We are inspired to embrace a biblical vision of stewardship drawn from 1 Corinthians 15:58 ”Be steadfast, immovable, always abounding in the work of the Lord, knowing that your labor is not in vain.” We seek to conquer our own complacency and fight the good fight for the flourishing of our families and our communities. We believe that this vision of stewardship is proactive, not passive, and that every dollar, moment, and calorie we invest carries the potential for God-glorifying transformational impact.

Pillars

-

Our heavy allocation to alternative asset classes flows from their return potential and diversifying power. Alternatives are often less efficiently priced than marketable securities, and we exploit these market inefficiencies through active management and cultivation of long term partnerships that yield consistently high quality proprietary private market opportunities. The partner families we serve are well suited for taking advantage of these illiquid, less efficient markets. Alternative asset classes such as venture capital, private equity, private credit, absolute return, and real assets drive higher return potential while insulating from the volatility of the public markets.

While, historically, access to these allocations has been limited to the size of the check and the deal flow network of the portfolio manager, the democratization of the private marketplace has given way to a new generation of allocation opportunities.

-

At the core of the Vincimus investment philosophy is an equity orientation rooted in the belief that entrepreneurial capitalism produces greater returns for investors and impact for society over a long-term horizon. Capitalism, though not perfect, still provides the best mechanism for society to create new value and create positive change. Competition drives innovation, and innovation detonates where it finds the right blend of fuel, safety, and incentives. The U.S. market continues to lead the way for entrepreneurs with big ideas leading to high growth businesses, new industries, and liquidity events.

-

Our Investment philosophy begins and ends with our ability to discover and develop world class investment partnerships and opportunities for our families. Because we begin with first principles and a values-based approach, our network of relationships, investors, and managers is of a quality and class generally unavailable to individuals and institutions alike. Our platform is energetic, opportunistic, and open-minded enabling our partner families to reap the benefits of an endowment portfolio strategy that historically has been available only to elite institutions.

Vincimus is passionate about partnership. Durable, lasting partnerships are the bedrock beneath our investment strategy. Partnering with both values-aligned families and investment managers over the long term enables us to take advantage of market inefficiencies which have the real potential to achieve market-beating returns over a long time horizon.

Vincimus builds long term relationships with exceptional managers who possess a clear thought process, a sound investment philosophy, and a passion for our shared values. Vincimus actively searches for partners who are focused on establishing long-term partnerships and building sustainable organizations.

Since Vincimus, as a firm, is driven by first principles and values, we do not shy away from partnerships with early-stage managers. In fact, we realize that those who share our values are often discounted by the public markets and coastal elite institutions, creating more opportunity for the families we serve. From our experience many of the least conventional partnerships have been our longest lasting and most fruitful.

-

For more than a decade, our team has built customized portfolios designed to weather and perform in the ever-evolving currents of the investment environment. As a firm we know that investment management involves as much art as science. The exponential increase of information and data available is undeniable in our lives and today’s public markets are driven by complex algorithms and quantitative analysis. But as disruptive, low probability events happen with more regularity we believe qualitative considerations play an extremely important role in portfolio decisions.

-

Our approach to private market allocation not only creates an opportunity to experience superior risk-adjusted returns, perhaps more importantly, it creates the needed transparency required to confidently deploy for targeted values alignment. The work of Investment allocation, at its core, is the work of stewardship, and stewardship is the heartbeat of our firm. It starts with who we are, and extends throughout our investment relationships. Each and every investment we make is an expression of who we are.

Long before corporations and institutional investors needed the stamp of approval of "ESG" (environment and social governance) or "SRI" (socially responsible investment) our society has known that responsible investing is so much more than that. Stewardship is an ancient and far more reaching concept. Stewardship teaches that every dollar invested is an opportunity to impact communities.

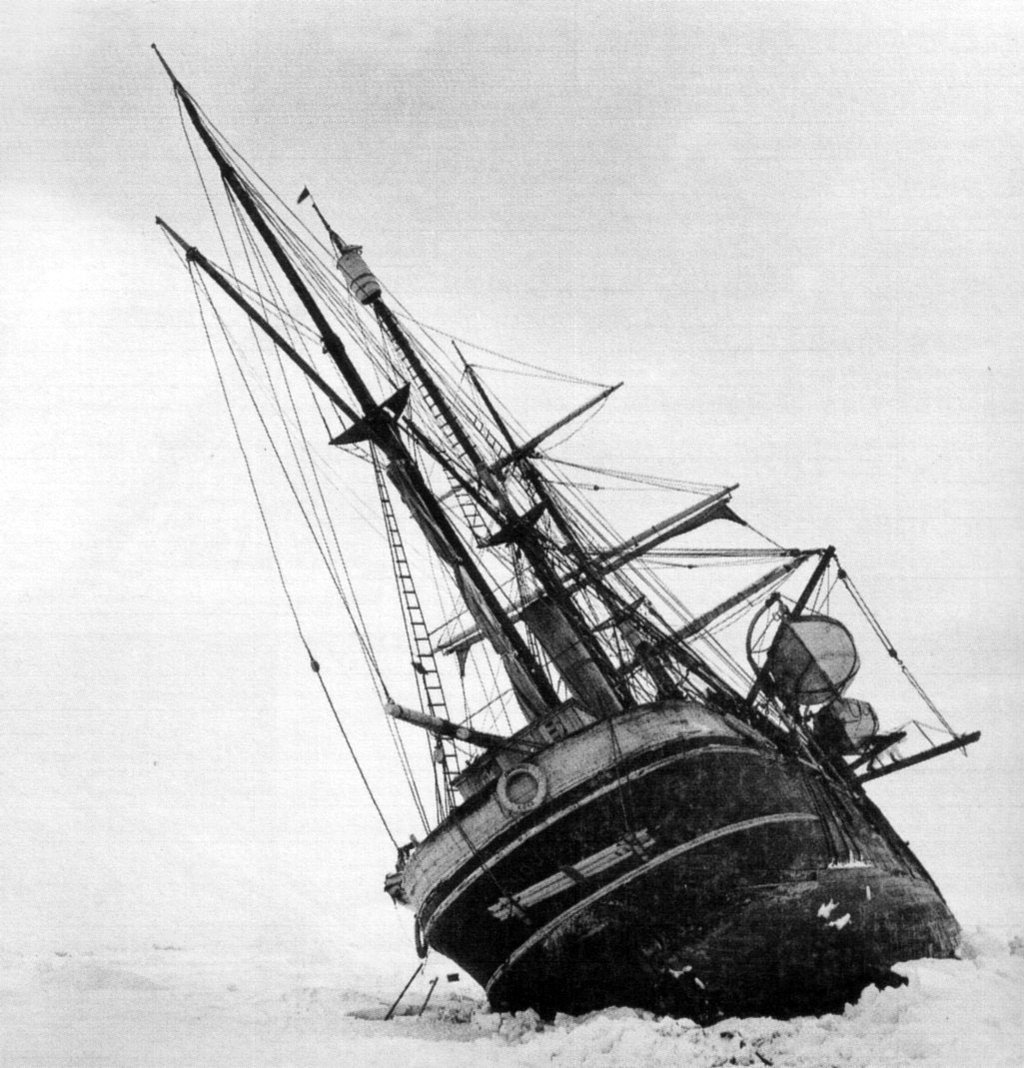

Fortitudine Vincimus

Vincimus Capital takes its inspiration from the family motto of British explorer Earnest Shackleton: "Fortitudine Vincimus," or "by endurance, we conquer." The phrase embodies the spirit of our firm and the community we are building as we dedicate ourselves to navigating the often-turbulent world of investing with resilience, determination, and an indomitable sense of adventure. Read more.

“…man is not made for defeat…[he] can be destroyed, but not defeated.”

— Ernest Hemingway, The Old Man and the Sea